Online payment gateways in Kenya are becoming increasingly popular as a means of conducting business on the internet. All of this is now feasible thanks to internet transaction gateways. Although, these online payment channels are now also the most convenient way to send money electronically.

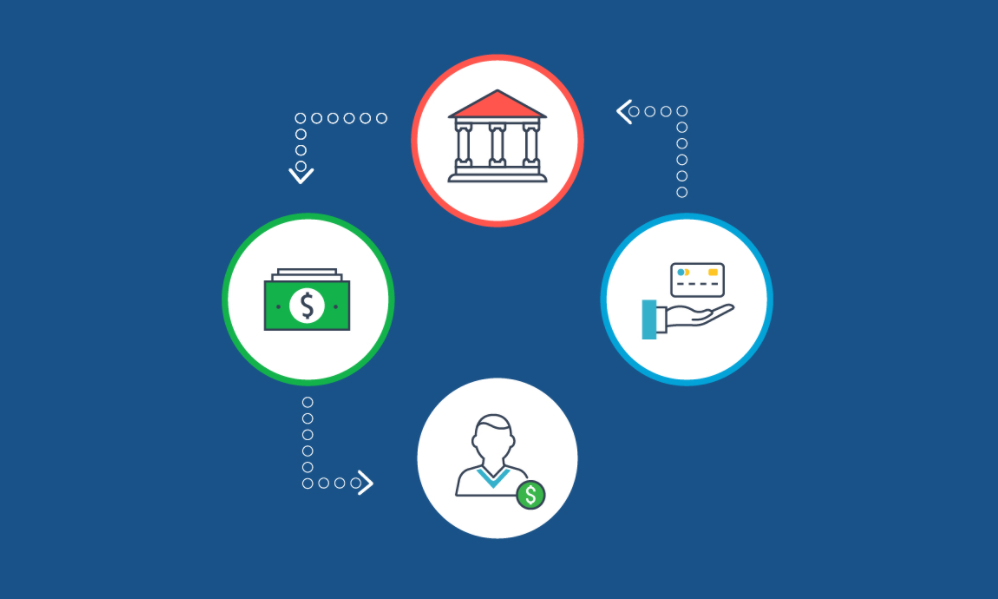

Financial organisations that operate as transfer agents between parties provide online payment gateways to buyers and sellers. Visitors may use online payment gateways to make payments and transfer money all over the world. Many online payment gateways also allow you to make payments online, by email or mobile phone, to submit an invoice, and so on. However, they offer an exchange of currency with affordable rates on international transactions.

There are numerous reasons why online payments channels have gained popularity. The first and most important is that it is convenient to pay and transfer money online; transactions are guaranteed for customers; security through encryption gives good protection.

Including an online payment system on your website allows your visitors to make purchases with ease. Selecting a payment gateway is a critical component of online payment. However, gateway compatibility is another vital element. Any online payments Kenya that is only compatible with a few other gateways inherently restricts its choices.

As a client, you may not want to do business with a service provider or merchant whose online payment gateway is incompatible with the most widely used systems. Here are some questions to focus on before deciding on a gateway.

- Will the gateway be compatible with the following systems: American Express, credit cards, Western Union, banks, and other gateways?

- Is each transaction guaranteed, with compensation if an issue occurs – or is it challenging to obtain help for complex transactions?

- Safety precautions – Will the system employ a digital signature? – This stops hackers from exploiting the system.

- Records of Dynamic IP address – Adding protection by checking the IP address used in previous internet transactions?

- Does the system contain 128-bit Secure Socket Layer security? – Does it automatically encrypt?

- How fast do transactions go through? – Checks might take many days to clear if they are not processed electronically, but a regular electronic money transfer from a funded account or a credit card transaction should be nearly quick.

Payment gateway services such as Google’s Checkout, MoneyBookers.com, PayPal, and Epay provide several useful features. Unfortunately, like with other internet issues, larger corporations become targets for hackers. For example, Internet Explorer is attacked more frequently than Firefox, and Microsoft Windows is hacked more frequently compared to Apple.

MoneyBookers.com is one of the solid payment gateways in Kenya that has not had severe issues with fraud, customer support, or security. They offer all of the essential services safely and swiftly.